Navigating the Commercial Space Maze

Looking for commercial space for lease? Here’s what you need to know:

- Average costs: Office space ($44.85/sq ft), Retail space ($53.63/sq ft), Industrial space ($28.32/sq ft) in major markets

- Space types: Office, Retail, Industrial, Mixed-use, Flex spaces

- Lease structures: Triple Net (NNN), Gross, Modified Gross, Percentage lease

- Typical requirements: Credit checks, security deposits, business financials, insurance

Finding the right commercial space for lease can feel like navigating a maze with no map. Whether you’re a retailer seeking high-visibility storefronts, an e-commerce company hunting for warehouse space, or a medical practice looking for patient-friendly facilities, the process can quickly become overwhelming.

The commercial leasing journey involves far more than just square footage and monthly rent. You’ll encounter complex lease terms, hidden costs, zoning requirements, and negotiation challenges that can impact your business for years to come.

In this comprehensive guide, we’ll walk through everything you need to know about securing the perfect commercial space without losing your mind in the process. From understanding different property types to negotiating favorable terms, we’ve got you covered with actionable insights and expert strategies.

I’m Brett Sherman, a commercial real estate advisor with over 15 years of experience helping businesses secure optimal commercial space for lease across diverse markets, using data-driven approaches to negotiate favorable terms and avoid costly pitfalls.

Commercial Space for Lease: Key Types & Suitability

Finding the right commercial space for lease is a bit like dating – you need to find the perfect match for your business’s unique personality and needs. Let’s explore the different property types available and help you determine which one might be your business’s soulmate.

Office vs. Flex vs. Coworking

When it comes to office environments, you’ve got options that range from buttoned-up to laid-back. Traditional office spaces come in three distinct flavors: the premium Class A buildings with all the bells and whistles, the comfortable middle-ground Class B spaces with good amenities at reasonable prices, and the no-frills Class C options in older buildings that prioritize function over fashion.

Right now in Brooklyn, you’ll find about 406 office listings spanning nearly 35 million square feet, with average asking rents hovering around $44.85 per square foot. These spaces range from sleek high-rise suites to character-filled lofts in converted warehouses.

For businesses that need a bit of everything, flex spaces offer the best of both worlds – typically featuring 30-50% office space combined with areas perfect for light manufacturing, product development, or assembly work. I recently helped a tech hardware startup find a 5,000 SF flex space in Doral that housed both their engineering team and assembly area under one roof – saving them significant headaches and costs compared to leasing separate properties.

Not ready to commit? Coworking spaces offer the speed-dating version of commercial real estate with month-to-month terms, fully furnished workstations, built-in amenities like meeting rooms and bottomless coffee, plus natural networking opportunities with neighboring businesses. These turnkey solutions are perfect for startups, remote teams testing new markets, or businesses in transition.

Retail Storefronts & Food-Forward Spaces

If your business thrives on foot traffic and visibility, retail might be your perfect match. Brooklyn currently offers 715 retail listings totaling nearly 20 million square feet, with average asking rents of $53.63 per square foot.

When evaluating retail spaces, pay special attention to frontage and visibility (those premium corner locations come with higher price tags but maximum exposure), foot traffic patterns (understanding when potential customers walk by and who they are), and co-tenancy (neighboring businesses that might send hungry customers your way after they finish shopping).

Food and beverage entrepreneurs face unique considerations. A second-generation restaurant space with existing hood vents, grease traps, and kitchen infrastructure can save you between $150,000 to $300,000 in build-out costs. For modern concepts, ghost kitchen facilities cater to delivery-only operations, while food hall stalls offer lower-cost entry points into high-traffic areas.

As our restaurant specialist at Signature Realty often says, “The difference between profitability and struggle in the restaurant business often comes down to how much you spend before serving your first meal.”

Industrial & Warehouse Essentials

For businesses that need room to store, ship, or manufacture, industrial spaces offer the most bang for your buck. Brooklyn currently features 237 industrial listings spanning over 20 million square feet, with average asking rents of $28.32 per square foot – significantly more affordable than office or retail options.

When hunting for the perfect warehouse or industrial space, focus on clear height (modern facilities typically offer 24-32 foot clearances), loading capabilities (the number and type of dock doors can dramatically impact operational efficiency), column spacing (wider spacing creates more flexible storage configurations), and power capacity (especially crucial for manufacturing operations). Don’t forget to verify zoning compliance to ensure your intended use is permitted.

The right industrial features can transform your operations. We recently helped an e-commerce client lease a 15,000 SF warehouse in Hialeah featuring four dock-high doors – a seemingly small detail that streamlined their shipping operations and slashed labor costs by 22% compared to their previous space with only grade-level access.

Whether you need a professional office environment, a high-visibility retail location, or an efficient industrial facility, understanding the key features of each commercial space for lease type will help you narrow your search and find the perfect home for your business to thrive.

Market Snapshot: Rental Rates, Vacancy & Trends

When you’re searching for commercial space for lease, knowing what’s happening in the market gives you a powerful advantage. Let’s take a closer look at the current landscape so you can make informed decisions about your next business home.

Brooklyn, NY Market Overview

Brooklyn has transformed from Manhattan’s sidekick into a commercial powerhouse in its own right. The borough offers incredible diversity across its neighborhoods:

| Property Type | Available Listings | Total Square Footage | Average Asking Rent (per SF) |

|---|---|---|---|

| Office | 406 | 34,939,560 | $44.85 |

| Retail | 715 | 19,941,575 | $53.63 |

| Industrial | 237 | 20,829,180 | $28.32 |

I’ve watched Brooklyn evolve dramatically over the past decade. What used to be purely industrial areas like DUMBO now command Manhattan-level rents, while neighborhoods further out still offer relative bargains. This creates opportunities at every price point.

One fascinating development has been the change of places like Industry City, where former manufacturing buildings have become vibrant mixed-use hubs hosting everything from tech startups to food halls.

Miami Market Dynamics

South Florida’s commercial landscape is booming, fueled by business relocations and population growth that shows no signs of slowing.

In Brickell and Downtown Miami, Class A office space now fetches between $55-75 per square foot – numbers that would have seemed impossible just five years ago. Meanwhile, areas like Doral and Airport West offer more budget-friendly options at $30-45 per square foot.

The retail picture varies wildly, from the eye-watering $90-250 per square foot on Miami Beach’s high streets to the more accessible $25-45 range in suburban shopping centers.

For businesses needing warehouse space, proximity to Miami International Airport comes at a premium ($12-18 per square foot), reflecting the critical importance of logistics in today’s economy.

Why Rates Vary Block-by-Block

I often have clients ask why one building costs significantly more than another just a block away. The answer lies in the fascinating microclimate of commercial real estate.

Sometimes a single street can mark the boundary between an established retail corridor and an up-and-coming area. I recently showed a client two retail spaces in Wynwood just three blocks apart with a 30% rent difference. Our foot traffic analysis revealed the pricier location would bring in 45% more potential customers – making it the better value despite the higher rent.

Building quality creates another dividing line. A renovated building with modern amenities, reliable HVAC, and robust internet infrastructure naturally commands higher rents than its aging neighbor with outdated systems.

Smart landlords also use incentives to make seemingly expensive spaces more affordable. These might include free rent periods (typically 3-6 months on a 5-year lease) or tenant improvement allowances that can significantly reduce your upfront costs.

Emerging Hotspots to Watch in 2024

Part of my job is spotting tomorrow’s hot neighborhoods before everyone else does. Here are four areas I’m particularly excited about:

Bushwick, Brooklyn continues its evolution from industrial grit to creative haven. Former warehouses now house media companies, design firms, and innovative startups at rates still below Williamsburg or DUMBO.

Gowanus, Brooklyn is experiencing a renaissance following recent rezoning. Its canal-adjacent location, which was once a liability, has become an asset as developers create waterfront office and retail experiences.

Wynwood, Miami has matured from an arts district into a prime commercial destination. While no longer the bargain it once was, continued development suggests long-term growth potential for businesses planting their flag here.

Little River, Miami reminds me of early Wynwood – still rough around the edges but with undeniable potential. For businesses willing to be pioneers, the value opportunities here are compelling.

“The secret to finding value isn’t just looking at today’s hot neighborhoods, but identifying where the momentum is heading next,” explains our research director at Signature Realty. “Our data analytics team tracks these patterns to help clients get ahead of market trends by 12-18 months.”

Understanding these market dynamics gives you leverage when negotiating your next commercial space for lease. The right location at the right time can transform not just your space, but your business’s entire trajectory.

Cost Drivers: Size, Layout, Location, Amenities

Finding the perfect commercial space for lease is exciting, but the sticker price is just the beginning of your cost story. Let’s break down what really drives your total investment beyond that headline rental rate.

How Much Commercial Space for Lease Do You Really Need?

One of the most common and costly mistakes I see businesses make is leasing too much—or too little—space. Getting this right starts with honest assessment.

For office settings, industry standards suggest about 150-250 square feet per employee, but this varies widely. If you’re planning an open collaborative environment, you’ll need less space than if everyone needs a private office. Our team at Signature Realty recently helped a Miami Beach law firm optimize their layout, reducing their space needs by 22% and saving them approximately $87,000 over their five-year lease term.

Retailers should think carefully about inventory storage, customer flow patterns, and checkout areas. Most small retail operations can function quite efficiently in 1,000-3,000 square feet, though your specific merchandise and display needs might adjust this range.

For industrial users, your calculation needs to account for inventory volume, equipment footprint, and the workflow of your operations. Those high ceiling warehouses might look impressive, but if you’re not stacking inventory, you could be paying for air you don’t need.

When planning for growth, don’t just think about today—consider your 18-24 month projections. Include space for new team members, additional storage requirements, and any specialized areas like server rooms or product testing spaces. A good rule of thumb: plan for growth, but don’t pay for space you won’t use for more than a year.

Layout & Build-Out Math That Saves Money

The efficiency of your space dramatically impacts what you’re actually paying for. Ever heard of loss factor? In many buildings, you’re paying for your share of common areas—lobbies, hallways, restrooms—through this factor that can add 15-20% to your usable square footage. That means your 1,000 square foot office might actually cost you for 1,200 square feet.

Space planning efficiency matters too. Those stylish columns might look architectural, but they can reduce your usable space by 10-15% if poorly positioned. Irregular shapes and excessive corridors eat into functional space as well.

Then there’s the build-out itself, which typically runs between $30-150 per square foot depending on quality level and existing conditions. This is where experience can save you significant money. Our Miami retail specialist recently found a client a second-generation space with an existing layout that matched 80% of their needs, saving them $45,000 in build-out costs and allowing them to open six weeks earlier than if they’d started with raw space.

Smart layout considerations that can reduce your overall costs include:

Column spacing makes a huge difference in how flexibly you can use your space. Wider spacing gives you more options for configuring workstations, retail displays, or industrial equipment.

Ceiling height isn’t just about aesthetics—higher ceilings create a sense of spaciousness that might allow you to lease less square footage while maintaining comfort.

Natural light access can transform a space. Offices with good window lines often need less square footage to feel comfortable and productive.

HVAC zoning might sound boring until your staff is fighting over the thermostat. Multiple zones provide better comfort and potential energy savings, especially in larger spaces.

At Signature Realty, we’ve found that these seemingly small layout details often have the biggest impact on both immediate costs and long-term satisfaction with your commercial space for lease. Our proprietary space calculator helps clients visualize these factors before signing, preventing expensive surprises down the road.

The cheapest space isn’t always the most economical in the long run. A well-designed 2,500 square foot space might serve your needs better than a poorly configured 3,000 square foot space—and save you thousands over the lease term.

Lease Structures & Negotiation Strategies

Understanding lease structures is crucial when evaluating commercial space for lease options. Different structures allocate costs and responsibilities differently between landlord and tenant:

Common Lease Types

When you’re looking at a commercial space for lease, you’ll encounter several lease structures, each with distinct advantages and challenges.

A Gross Lease is like the all-inclusive resort of commercial leases. You pay one flat rent amount, and your landlord handles most operating expenses. This simplicity provides budget certainty but typically comes with higher base rents. Many office tenants prefer this structure for its predictability.

The Triple Net (NNN) Lease is more like ordering à la carte. You pay a base rent plus the three “nets”—property taxes, insurance, and maintenance. While this structure offers lower base rents, it requires careful budgeting for those variable expenses. Retail and industrial properties commonly use this approach.

A Modified Gross Lease strikes a middle ground. Think of it as a buffet where some items cost extra. Certain expenses are covered by the landlord and others by you. For example, you might handle utilities and janitorial services while your landlord covers taxes and insurance.

The Percentage Lease, common in retail, includes base rent plus a percentage of gross sales above a specified threshold. This approach aligns landlord and tenant interests—they succeed when you succeed—but requires sharing your sales data, which some businesses prefer to keep private.

Negotiating the Best Deal on Commercial Space for Lease

Effective negotiation can dramatically impact your bottom line. At Signature Realty, we’ve saved clients thousands by focusing on these key areas:

Free rent periods can be a game-changer, especially for spaces requiring significant build-out. We recently secured four months of free rent for a tech startup moving into a Wynwood office space, saving them nearly $40,000 while they completed their custom build-out. These concessions typically range from 1-6 months depending on lease length and market conditions.

Tenant improvement allowances (TI dollars) help offset your build-out costs. One client was initially offered $15 per square foot for improvements, but our market analysis showed comparable properties offering $35-40. We secured $38 per square foot, adding $115,000 in landlord contributions to their build-out budget.

Capped expenses protect you from unexpected cost increases. In triple-net leases, operating expenses can balloon unexpectedly. We typically negotiate caps of 2-3% annually on these increases, providing budget predictability.

Flexible terms future-proof your lease. This includes renewal options at predetermined rates, expansion rights to adjacent spaces, termination options with reasonable penalties, and sublease rights with minimal landlord restrictions.

“Using our AI deal analyzer, we identified that a landlord’s ‘best offer’ for one client was actually 22% above market value for comparable properties,” notes our negotiation specialist. “Armed with this data, we secured a 15% rent reduction plus an additional month of free rent.”

For more detailed strategies, check out our guide on how to negotiate a commercial lease agreement.

Tenant Protections & Common Pitfalls

The fine print matters enormously in commercial leases. These protections can save you from costly surprises:

Space delivery conditions should be explicitly defined. I remember one client who moved into their new space only to find the HVAC system didn’t work properly—during Miami’s hottest month! Now we always include specific language about working systems, ADA compliance, environmental hazard remediation, and building code compliance.

Personal guaranty limitations protect your personal assets. While landlords often request unlimited personal guarantees, we typically negotiate burn-off provisions that reduce guarantee obligations over time, cap guarantee amounts to specific dollar figures, or substitute security deposits or letters of credit instead.

Default and remedy provisions need careful attention. Ensure you have reasonable cure periods for any potential defaults and clear procedures for resolving disputes.

One restaurant client nearly signed a lease with a vague delivery date that could have left them paying rent on an unfinished space. We negotiated a firm delivery date with penalties if the landlord failed to deliver on time—which ultimately saved them three months of rent payments when construction delays occurred.

Commercial leases are complex documents that can run 50+ pages. Having an experienced advocate in your corner makes all the difference between a lease that works for your business and one that works against it.

Leasing Process & Tools: From Search to Signing

Finding the perfect commercial space for lease might feel overwhelming, but breaking it down into manageable steps makes the journey much smoother. Think of it as planning a road trip—you need to know where you’re going, what route to take, and what to watch out for along the way.

The Commercial Leasing Timeline

The path to your ideal space typically follows five key phases, though timing can flex based on your needs and local market conditions.

Your journey begins with a thorough needs analysis, usually taking 1-2 weeks. This is where you’ll define what you’re really looking for—how much space you need, what you can afford, and where you want to be. It’s like creating a wish list for your dream home, but with more spreadsheets! During this phase, you’ll also want to assemble your team of experts, including a broker, attorney, and possibly an architect.

Next comes the property search, which typically spans 2-8 weeks. This is where the excitement builds as you explore what’s available. Your broker will help you access listings through platforms like LoopNet and CoStar, but the real magic often happens through their network of connections that can uncover those hidden gem off-market properties. You’ll tour promising spaces and gradually narrow down your options.

Once you’ve identified potential matches, you’ll enter the proposal and negotiation phase, lasting about 2-6 weeks. This is where having a skilled broker really pays dividends. They’ll help you submit requests for proposals to landlords, negotiate the letter of intent outlining key business terms, and compare offers across multiple properties. It’s a bit like playing poker—you need to know when to hold firm and when to compromise.

The lease drafting and review phase follows, typically taking 2-4 weeks. The landlord will prepare a lease based on your agreed-upon terms, then your attorney will review and negotiate the fine print. This stage is crucial—what seems like minor legal language can have major implications for your business down the road.

Finally, you reach the build-out and move-in phase, which varies widely in duration depending on the condition of the space and the complexity of your needs. This includes space planning, design, permitting, construction, and ultimately, the exciting day when you get to move in!

At Signature Realty, we’ve streamlined this process with our proprietary AI deal analyzer, which can quickly evaluate multiple properties against your specific criteria. One client recently told us, “What would have taken me weeks of spreadsheet comparisons happened in minutes. I could actually see the differences between properties that mattered most to my business.”

Tech & Platforms That Speed Up the Hunt

Today’s technology has transformed the commercial space for lease search from a paper-heavy marathon into a more efficient sprint.

Online listing platforms have become the starting point for most searches. LoopNet and CoStar host the largest databases of commercial properties, though many premium listings require broker access. Local MLS systems provide additional options in some markets, while brokerage websites often feature exclusive listings you won’t find elsewhere. It’s like having multiple scouts working for you simultaneously!

Space planning tools help you visualize possibilities before committing. Office space calculators determine appropriate square footage based on your headcount and workspace style. Virtual space planning tools let you create preliminary layouts to see how your team would fit. And 3D virtual tours—a game-changer in recent years—allow you to explore spaces remotely.

“Using virtual tour technology, we helped a Miami client based in New York narrow ten potential spaces down to three finalists before they ever boarded a plane,” explains our technology specialist. “This saved them significant time and travel expenses while accelerating their decision process.”

These tools are especially valuable when you’re expanding to a new market or working under tight timelines. One of our clients, a tech company expanding from San Francisco to Miami, was able to tour fifteen spaces virtually in a single afternoon—something that would have required days of travel and thousands in expenses just a few years ago.

Red-Flag Checklist Before You Sign

Before you sign on the dotted line for that commercial space for lease, take a moment to verify these critical items. Think of it as your pre-flight safety check—a few minutes of diligence now can prevent major turbulence later.

First, confirm zoning and use compliance. Make sure your intended business use is permitted under current zoning regulations and that any necessary permits or licenses can be obtained. We once worked with a client who nearly signed a lease for a food concept, only to find the space wasn’t properly zoned for restaurant use—a potential disaster averted through proper due diligence.

Next, verify building systems and infrastructure. This includes checking the condition and capacity of HVAC systems, electrical service, plumbing, telecommunications infrastructure, and ADA compliance. These unglamorous details can make or break your daily operations and lead to unexpected expenses if not properly evaluated.

Be vigilant about hidden charges lurking in the lease. Review carefully for potential cost surprises like after-hours HVAC charges, building security or access fees, parking costs, signage fees, and common area maintenance reconciliations. These can add up quickly and blow your carefully planned budget.

Finally, understand your exit strategy if business circumstances change. Check your assignment and sublease rights, early termination provisions, and renewal options and terms. Business needs evolve, and you want a lease that can adapt with you rather than become a financial anchor.

“We once reviewed a lease for a client that included a seemingly standard operating expense clause,” recalls our legal consultant. “Our detailed analysis revealed unusual capital expense pass-throughs that would have added approximately $4.50 per square foot annually—nearly 15% of their base rent—that wasn’t accounted for in their budget.”

This attention to detail is why having experienced professionals on your side matters. At Signature Realty, we’ve seen just about every trick in the book, and we use that knowledge to protect our clients from unpleasant surprises. After all, the perfect space isn’t just about location and aesthetics—it’s about creating a solid foundation for your business to thrive.

Frequently Asked Questions about Commercial Space for Lease

What documents will landlords require?

When you’re ready to make a move on that perfect commercial space for lease, landlords won’t just take your word that you’re a great tenant – they’ll want to see the paperwork to back it up.

Most commercial landlords will request a comprehensive financial package to evaluate your business stability. This typically includes 2-3 years of business tax returns that show your revenue history, along with current profit and loss statements that demonstrate your ongoing operations. Your balance sheets will also be scrutinized to assess your overall financial health, and recent bank statements help verify your cash flow situation.

“I always tell my clients to prepare their financial package before we even start touring spaces,” says our tenant rep specialist at Signature Realty. “When you find that perfect space, being able to submit a complete package immediately can give you a serious edge over other interested tenants.”

For newer businesses without extensive financial history, a detailed business plan becomes especially important. This helps landlords understand your growth trajectory and revenue potential.

Beyond the financials, landlords will request legal documentation including your articles of incorporation or organization and relevant business licenses. You’ll also need proof of insurance or the ability to obtain the coverage levels required in the lease.

Don’t forget about references! Banking relationships, trade references, and especially previous landlord references can significantly strengthen your application. A glowing review from a past landlord can sometimes overcome modest financial shortcomings.

The strength of your overall package directly impacts your negotiating leverage. Our team at Signature Realty helps clients prepare professional packages that highlight their stability while minimizing potential concerns – giving you the best chance at securing favorable terms.

How long should my initial lease term be?

Finding the sweet spot for your lease term is like dating – commit too quickly and you might regret it, but play it too cautious and you’ll miss out on the best benefits.

Short-term leases (1-3 years) offer maximum flexibility, which is perfect if your business is in rapid growth mode or if you’re testing a new location. However, this flexibility comes at a price – landlords offer fewer concessions on short terms, and your per-year rent will typically be higher. You’ll also face more frequent renegotiations, which means more uncertainty.

“One of our retail clients insisted on a one-year lease for their first location,” shares our leasing advisor. “They ended up loving the space but had to renegotiate at a 12% higher rate just when their business was taking off. Had they committed to three years initially, they would have locked in significantly better terms.”

Mid-term leases (3-5 years) strike a balance that works well for many businesses. You’ll receive better landlord concessions like improvement allowances and free rent periods, while maintaining reasonable flexibility. This timeframe provides moderate rent stability while not locking you into a space that might become too small as your business grows.

Long-term leases (5+ years) open up the maximum benefits from landlords. You’ll receive the most generous improvement allowances, the greatest rent stability, and often the most favorable base rates. The tradeoff is reduced flexibility – if your business needs change dramatically, you could be stuck with unsuitable space or facing costly buyout negotiations.

The right choice depends heavily on your business stage and growth expectations. Established businesses with stable operations often benefit from longer terms, while rapidly evolving companies might be better served by shorter base terms with renewal options that provide future flexibility.

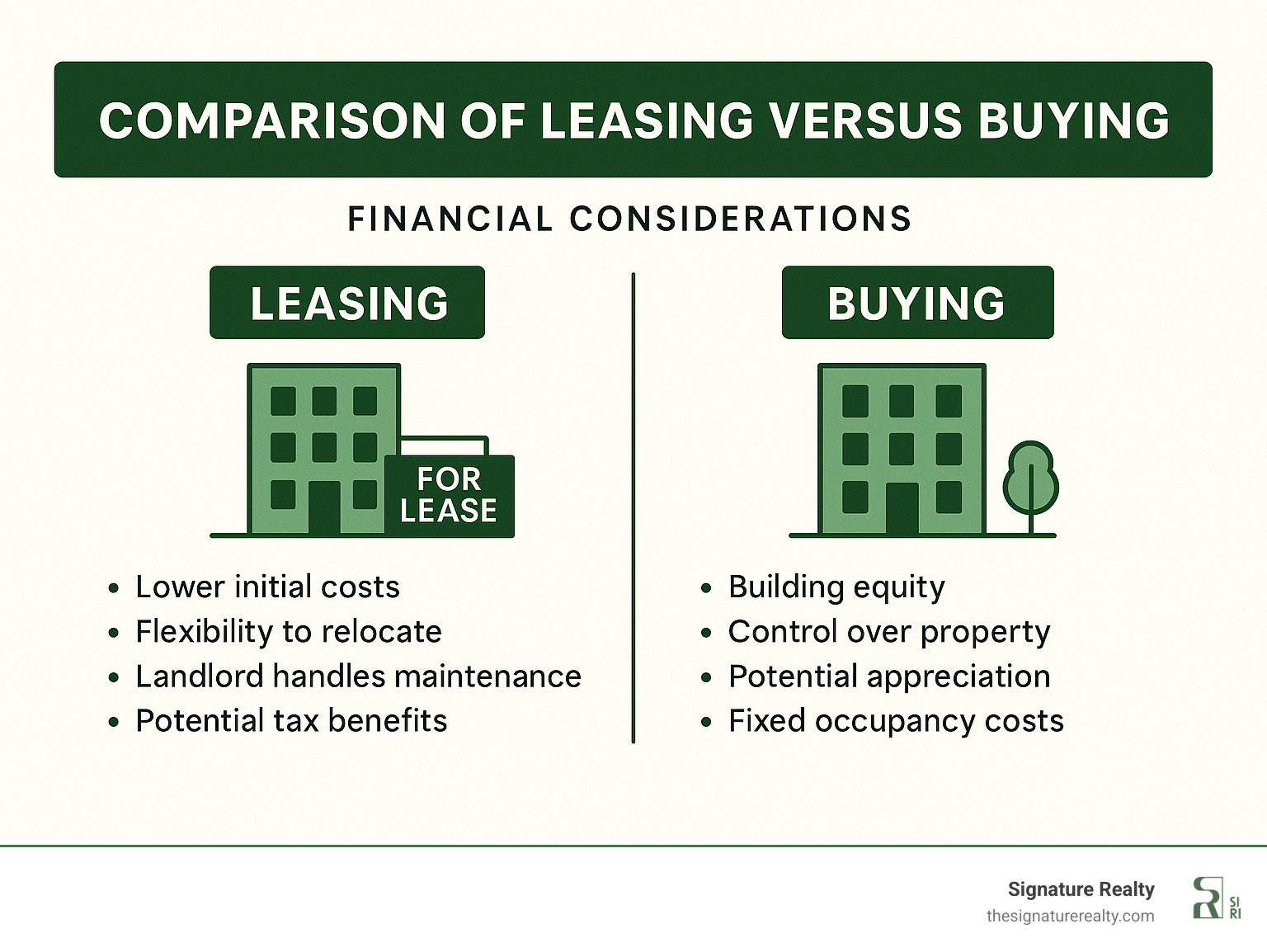

Lease vs. buy: which makes more sense?

The lease-versus-buy question keeps many business owners up at night – and rightfully so, as it’s one of the most significant financial decisions you’ll make.

Leasing a commercial space for lease requires lower initial capital, which means you can preserve your cash for core business operations like inventory, marketing, and hiring. This approach gives you the flexibility to relocate as your needs change without the hassle of selling property. When you lease, the landlord handles major building maintenance, saving you from unexpected capital expenditures like roof replacements or HVAC overhauls. From a tax perspective, your rent payments are typically fully deductible as business expenses.

“I had a client who was dead-set on buying until we ran the numbers,” recalls our investment specialist. “When they realized they could use that same capital to open two additional locations instead, the decision became much clearer. Five years later, they now own two properties – but the leasing strategy allowed them to scale much faster initially.”

Buying offers its own compelling advantages. You build equity with each mortgage payment instead of simply paying rent with nothing to show for it long-term. You’ll have complete control over property improvements without needing landlord approval. If the location appreciates in value, you benefit from that upside rather than your landlord. With fixed-rate financing, your occupancy costs become predictable over the long term. Some businesses even generate additional income by purchasing larger spaces and leasing out the excess.

At Signature Realty, we analyze this decision using a comprehensive model that accounts for opportunity cost of capital, tax implications, and long-term occupancy plans. For many businesses, leasing makes more financial sense in the first 5-7 years, with ownership becoming more advantageous beyond that timeframe – though market conditions and business-specific factors can shift this calculation significantly.

The right choice ultimately depends on your business priorities, growth plans, and financial situation. Our advisors can help you run the numbers specific to your circumstances so you can make this decision with confidence rather than uncertainty.

Conclusion

Finding the right commercial space for lease doesn’t have to feel like searching for a needle in a haystack. With thoughtful planning, solid market knowledge, and an eye for detail, you can secure a space that helps your business thrive rather than just survive.

The commercial leasing journey has many moving parts – from understanding different property types to negotiating favorable terms that protect your interests. While it may seem overwhelming at first glance, having a clear roadmap and experienced guidance makes all the difference.

At Signature Realty, we’ve spent over 13 years helping businesses steer the commercial real estate waters across Miami, Broward County, and South Florida. Our approach isn’t just about showing you spaces – it’s about understanding your business needs and finding properties that align with your strategic goals. Our data-driven strategies have saved clients over $2 million in lease negotiations, proving that expert guidance pays for itself many times over.

We’re particularly proud of our proprietary AI deal analyzer, which cuts through the noise to identify truly valuable opportunities. This technology helps our clients avoid the common pitfall of information overload, allowing them to make confident decisions based on clear, relevant data.

Whether you’re looking for a hip retail storefront in Wynwood, a professional office suite in Brickell, or a spacious warehouse in Doral, our tenant representation services ensure someone is in your corner throughout the entire process. We know the local markets block-by-block, giving you insights you simply won’t find scrolling through online listings.

Ready to find your perfect commercial space for lease? Let’s have a conversation about your needs. Our team offers complimentary consultations and customized market overviews that address your specific situation – no generic presentations or high-pressure sales tactics.

For businesses seeking deeper market intelligence, our Florida Market Reports provide the latest trends, data points, and forecasts to inform your real estate decisions.

The right commercial space does more than just house your business – it can become a strategic advantage that improves your operations, lifts your brand, and contributes to your bottom line. With the right approach and the right partner, you’ll not only find space for today but position your business for tomorrow’s growth and opportunities.