Navigating the Commercial Property Landscape

Commercial property for lease options include office space, retail storefronts, industrial warehouses, and flex spaces – typically available in various lease structures:

| Property Type | Typical Lease Term | Common Lease Structure | Key Considerations |

|---|---|---|---|

| Office | 3-5 years | Gross or Modified Gross | Class (A/B/C), Layout, Amenities |

| Retail | 5-10 years | Triple Net (NNN) | Foot Traffic, Visibility, Co-tenants |

| Industrial | 3-7 years | Triple Net (NNN) | Clear Height, Loading Docks, Zoning |

| Flex Space | 1-5 years | Modified Gross | Office/Warehouse Ratio, Accessibility |

| Co-working | Month-to-Month | All-Inclusive | Flexibility, Networking, Amenities |

Finding the right commercial property for lease can feel overwhelming. The process involves understanding different property types, lease structures, hidden costs, and negotiation strategies that can significantly impact your bottom line.

Unlike residential leases, commercial leases come with complex terms like “triple net,” “CAM charges,” and “TI allowances” that directly affect your total occupancy costs. Lease terms typically range from 3-10 years, making the decision even more consequential for your business.

The commercial leasing landscape is constantly evolving. With office spaces averaging $18-$50 per square foot depending on class and location, retail spaces commanding premium rates in high-traffic areas, and industrial spaces varying widely based on clear heights and loading capabilities, understanding market rates is critical.

My name is Brett Sherman, and I’ve negotiated over 200 commercial property for lease transactions, helping tenants save an average of 15% on occupancy costs through AI-driven market analytics and aggressive lease negotiation techniques. I’ll guide you through the essential steps to secure the ideal commercial space for your business needs.

Commercial property for lease vocab explained:

– commercial building for sale

– commercial property for rent

Understanding Commercial Property for Lease Types

The first step in your commercial leasing journey is understanding the different property types available. Each comes with unique characteristics, advantages, and cost structures that will impact your business operations.

Office & Retail Basics

When I’m showing clients around Miami, I often explain that office spaces come in three distinct flavors:

Class A spaces are the showstoppers of the commercial world. Think gleaming downtown Miami high-rises with marble lobbies where the security guard knows everyone by name. These premium buildings offer state-of-the-art systems and professional management, but they’ll set you back about $35-50 per square foot in South Florida.

Class B buildings are like the reliable middle child – not as flashy as Class A, but well-maintained with good management and decent finishes. You’ll find these in places like Doral or secondary business districts, typically ranging from $25-35 per square foot.

Class C spaces are the no-frills option – functional but dated with minimal amenities. Often tucked away in less desirable locations like industrial areas of Hialeah, they’re budget-friendly at $18-25 per square foot.

When touring office spaces, I always point out the floorplate – that’s the shape and layout of the floor. A good floorplate makes every square foot count. I remember a law firm client in Broward County who came in dead-set on Class A space. After showing them a beautifully renovated Class B building, they were sold – 30% more space for the same budget, plus they fell in love with the character of the older building.

For retail spaces, it’s all about location, location, and yes, location. When I walk clients through retail options, we focus on:

Foot traffic – I always say your best salesperson might be the sidewalk outside your door. The number of potential customers passing by can make or break a retail business.

Signage opportunities are crucial too – will people driving by at 45 mph be able to spot your business? Good visibility from streets and highways translates directly to walk-ins.

Your co-tenants matter enormously. I recently helped a boutique fitness studio lease space next to a high-end grocery store, and their morning class attendance doubled in the first month thanks to the shared customer base.

Anchor tenants – those big-name stores that draw crowds – can be retail gold. A space near a popular Target or Whole Foods comes with built-in customer traffic.

A retail client of mine leased space in a Columbia, SC shopping center with 25,000 vehicles passing daily. Within six months, they tracked that 40% of their new customers mentioned “seeing the store while driving by.”

Industrial, Warehouse & Flex Space

Industrial and warehouse spaces have their own unique language. When touring these properties, here’s what I help clients evaluate:

Clear heights are the usable height from floor to the lowest hanging obstacle. This might seem technical, but it’s critical – modern warehouses typically offer 24-32 feet of clearance. That vertical space is money in the bank.

Loading docks are those raised platforms that make loading and unloading efficient. The number, type, and position of docks can dramatically impact operational efficiency.

Column spacing affects how you’ll lay out your storage. Wider spacing means more flexibility and fewer obstacles for equipment.

Power capacity is especially crucial for manufacturing clients. I always check whether the electrical service can handle specialized equipment needs.

Logistics corridors – proximity to major transportation routes – can save thousands in shipping costs annually.

I recently worked with a distribution company looking near Miami International Airport. We found them a warehouse with 28-foot clear heights, which allowed them to install mezzanine storage. That clever use of vertical space effectively increased their usable area by 15% without paying a penny more in rent.

Flex spaces are the Swiss Army knives of commercial real estate, combining office and industrial elements. Typically, you’ll have office space in the front (usually 20-30% of the total) with warehouse, light manufacturing, or R&D space in the back. These spaces offer higher parking ratios than pure industrial and can be reconfigured as your business evolves.

I find flex spaces perfect for businesses in transition – like the tech startup I worked with that needed both coding space for their developers and light assembly areas for their prototype hardware. As they grew, they simply adjusted the office-to-warehouse ratio without the disruption of moving.

Whether you’re considering a traditional commercial property for lease or exploring more flexible options, understanding these basic property types will help you narrow your search. At Signature Realty, we analyze current market comps and demand statistics to ensure you’re making informed decisions based on the latest data, not just gut feeling.

Choosing the Right Space for Your Business

Finding that perfect commercial property for lease is like finding the right pair of shoes – it needs to fit well today while giving you room to grow tomorrow. Let’s walk through how to match your business needs with the ideal commercial space.

Location & Neighborhood Analysis

I can’t stress this enough – location truly is everything in commercial real estate. When my clients are evaluating potential spots, I always have them consider:

The daily commute times for employees. I’ve seen how a central Miami-Dade location can turn grumpy morning staff into happier, more productive team members.

Your proximity to clients matters too. Being just a short drive from your customer base means easier face-to-face meetings and often stronger relationships.

Don’t underestimate the power of nearby amenities. Those lunch spots, coffee shops, and gyms aren’t just nice-to-haves – they’re part of what makes a workspace enjoyable.

For retail businesses, those traffic counts translate directly to eyeballs on your business. More cars passing by generally means more potential customers walking through your door.

I remember working with a financial services firm that had their heart set on a prestigious Brickell address. But after we analyzed their client data, we finded 70% of their high-value clients were actually in Coral Gables. The move there not only cut their rent by 15% but put them right where they needed to be. Win-win!

When you’re sizing up neighborhoods, also keep an eye on economic incentives (some areas offer significant tax breaks), safety and security considerations, and any future development plans that might improve or detract from the area’s appeal.

Space Programming & Future-Proofing

Planning your space needs is about balancing today’s reality with tomorrow’s possibilities:

Your current headcount gives us a starting point. While traditional offices typically need about 150-250 square feet per employee, I’ve seen this vary widely by industry. Tech companies often want more collaborative space, while law firms might need more private offices.

Always factor in your growth projections. I generally recommend planning for 3-5 years of anticipated growth – you don’t want to outgrow your space halfway through your lease term.

Understanding your workflow analysis helps determine the right layout. How do your teams collaborate? Do you need quiet zones? Conference rooms? The answers shape your ideal floor plan.

The best leases include options that let your space evolve with your business:

Expansion options give you the right to claim adjacent space when it becomes available – I’ve seen this save growing businesses from painful relocations.

Contraction options provide flexibility if you need to downsize, while renewal options at predetermined rates protect you from sudden market jumps.

Don’t overlook tenant improvement (TI) allowances – these landlord contributions can significantly offset the costs of customizing your space.

One of my favorite success stories involves a tech company in Doral. We negotiated their 7-year lease with expansion rights to adjacent spaces and a mid-term termination option. When they unexpectedly doubled their team in year three, they expanded seamlessly without the disruption and expense of relocating. That’s the power of forward-thinking lease terms!

For more detailed guidance on finding your ideal commercial space, check out our Commercial Space for Lease resource center.

Crunching the Numbers: Lease Structures, CAM & Valuation

Let’s talk money – because when it comes to a commercial property for lease, what you see isn’t always what you pay. Understanding the financial side of commercial leasing can save you from budget-busting surprises down the road.

Lease Types Decoded

Commercial leases come in several flavors, and knowing the difference is like understanding the fine print on a car loan – absolutely essential.

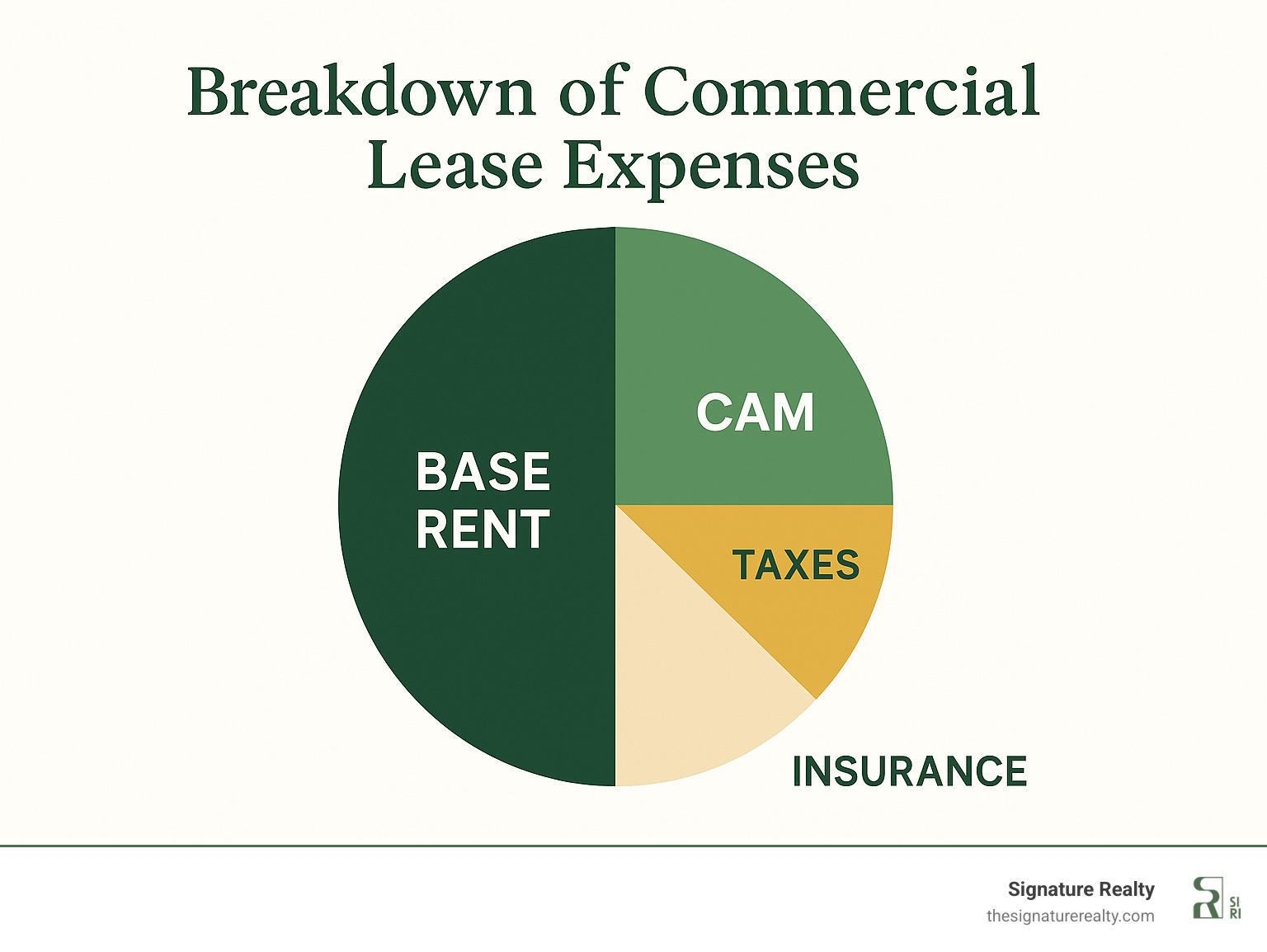

Triple Net (NNN) Lease is the most common structure for retail and industrial properties. Think of it as “you pay for everything” – you’ll cover base rent PLUS property taxes, insurance, and maintenance costs (those pesky CAM charges we’ll get to in a minute).

For example, that shiny 5,000 sq ft retail space advertised at $25/sq ft might actually cost you $33-37/sq ft when all is said and done. Those extra $8-12 per square foot add up quickly – that’s potentially an extra $60,000 annually on a 5,000 sq ft space!

Gross Lease is the “all-inclusive resort” of commercial leases. One payment covers virtually everything, with the landlord handling most operating expenses. While the base rent is typically higher than a triple net lease, you’ll enjoy more predictable monthly expenses. These are most common in office buildings where tenants share many services.

Modified Gross Lease sits somewhere in the middle – like ordering à la carte instead of prix fixe. Some expenses are baked into your rent while others pass through to you. Often, you’ll cover your own utilities and janitorial services while the landlord handles structural maintenance and common areas. This structure offers more flexibility in negotiations.

“I’ll never forget the restaurant owner who nearly had a heart attack when he got hit with a $15,000 year-end CAM reconciliation bill,” shares Brett Sherman, our leasing director. “He simply hadn’t understood his lease structure. Now we make sure every client knows exactly what they’re signing up for – no surprises.”

How a commercial property for lease is valued

Understanding how landlords value their properties gives you powerful negotiating leverage. Commercial properties are typically valued in three ways:

The Income Approach is most common – it’s all about the money the property can generate. Owners apply a capitalization rate (cap rate) to the net operating income to determine value. In today’s Miami market, office buildings typically trade at 4.5-6% cap rates, with lower rates indicating higher property values. When a landlord quotes a seemingly inflexible rental rate, they’re often protecting their property’s valuation.

The Market Comparison Approach looks at similar properties recently leased or sold nearby. This is essentially the “comps” method you might be familiar with from residential real estate, with adjustments made for differences in location, quality, and building features. This approach helps establish what’s truly “fair market rent” in your area.

The Cost Approach calculates value based on what it would cost to replace the building plus the land value. While less commonly used for leasing decisions, understanding the landlord’s investment helps you contextualize their rental requirements and renovation allowances.

“Last month, we used our AI deal analyzer to compare a client’s lease proposal against 27 similar transactions in Broward County,” explains our data specialist. “We finded they were being offered rates 12% above market, which gave us the ammunition to negotiate a $1.2 million savings over their lease term. Data is power in these negotiations.”

Explaining CAM Charges

Common Area Maintenance (CAM) charges are often the most misunderstood part of commercial leases. These cover the shared spaces and services everyone in the building benefits from – think of them as the “homeowners association fees” of commercial real estate.

CAM typically covers landscaping and exterior maintenance, janitorial services for common areas, parking lot upkeep and lighting, security systems and personnel, and administrative fees (usually 10-15% of total CAM costs). These charges are generally estimated annually, billed monthly, and reconciled at year-end – which can lead to surprise bills if you’re not careful.

Your share of CAM is typically proportional to your percentage of the building’s total leasable area. If you lease 2,000 square feet in a 20,000 square foot building, you’ll pay 10% of the total CAM expenses.

“A retail client in Miami Beach was unknowingly paying CAM charges based on 110% of their actual square footage due to a measurement error,” reveals our tenant rep specialist. “We caught this during our lease review and saved them over $7,000 annually. Always verify your proportional share calculation – those few percentage points add up dramatically over a five-year lease.”

For more detailed information on commercial lease financials, check out our comprehensive FAQs section where we break down even more cost considerations.

The Leasing Journey Step-by-Step

Finding and securing the perfect commercial property for lease is a bit like planning a road trip—there’s a clear route to follow, with important stops along the way. Let me walk you through this journey with some real-world insights that will make your experience smoother.

Timeline & Documentation Checklist

From my experience helping hundreds of Miami businesses find their ideal space, I can tell you that the typical commercial lease process takes about 2-6 months from start to finish. Here’s what that journey looks like:

The process begins with the exciting part—searching and touring properties, which usually takes 2-4 weeks. This is when you’ll define what you need, review what’s available, and visit the spaces that catch your eye. I remember taking a tech startup around Wynwood last year—they thought they wanted a traditional office until they stepped into a converted warehouse space and immediately fell in love with the creative energy.

Next comes the Letter of Intent (LOI) stage, typically lasting 1-2 weeks. This non-binding proposal outlines the key terms you want, setting the stage for negotiations on the business points. Think of it as sketching the blueprint before building the house.

The lease negotiation phase that follows is where patience comes in handy—it can take 2-6 weeks as attorneys review drafts, negotiate legal terms, and finalize the document. This is where having an experienced advocate really pays off.

Due diligence follows for about 1-3 weeks, where you’ll verify measurements (trust but verify!), inspect building systems, and confirm zoning compliance. I’ve seen deals fall apart at this stage when tenants find the actual square footage is significantly different than advertised.

Finally, you’ll reach the execution and move-in preparation phase (1-4 weeks), where you’ll sign the lease, secure insurance, plan tenant improvements, and coordinate your move.

Landlords typically want to see some combination of these documents before approving your lease:

Financial documentation is crucial—most landlords want to see 2-3 years of business financial statements and tax returns. For newer businesses, a solid business plan can help make your case. Personal financial statements are often required for guarantors, along with bank references, proof of insurance, and your business formation documents.

“One of our Doral clients lost their dream location because they couldn’t produce financial documentation quickly enough,” our transaction manager often reminds new clients. “We now provide all clients with a documentation preparation checklist at the beginning of the search process to avoid such disappointments.”

Negotiating a commercial property for lease like a pro

The rental rate is just the tip of the iceberg when it comes to lease negotiations. The real value often lies in the concessions and terms you secure.

Rent concessions can dramatically improve your bottom line. Free rent periods (typically 1 month per lease year) provide valuable breathing room, especially during the initial setup phase. Stepped rent structures start with lower rates in early years and increase gradually, helping with cash flow when you need it most. And don’t forget to negotiate caps on annual increases—without them, you could face unexpected jumps in your occupancy costs.

Tenant improvement allowances are essential for customizing your space. In Miami, these allowances range from $15-60 per square foot depending on property class and lease term. They can be structured as turnkey build-outs where the landlord handles everything, or as dollar allowances where you manage the process. Some landlords will even include design services and permitting costs.

Flexibility options protect your future interests. Rights of first refusal on adjacent spaces give you room to grow. Termination options provide an escape hatch if needed. Renewal options at predetermined rates shield you from market spikes. And don’t underestimate the value of assignment and subletting rights—these can be lifesavers if your business circumstances change.

I’m particularly proud of a recent win for a professional services firm in Miami Beach. “We negotiated 8 months of free rent on a 7-year lease,” shares our lead negotiator. “The landlord initially offered just 3 months, but our market data showed comparable deals receiving much more favorable terms. This saved our client over $200,000 in occupancy costs.”

For more detailed strategies, check out our guides on How to Negotiate a Commercial Lease Agreement and How to Negotiate Free Rent for a Commercial Lease.

Avoiding Pitfalls & Leveraging Professionals

Let’s face it – even the savviest business owners can stumble when navigating the complex world of commercial property for lease. After seeing hundreds of deals over the years, I’ve watched smart people make the same mistakes again and again. But don’t worry, I’m here to help you avoid those costly missteps.

Why Use a Broker & How They’re Paid

Think of a tenant representation broker as your commercial real estate sherpa – someone who knows the terrain and can guide you safely to your destination. Here’s what a good broker brings to the table:

Your broker gives you market intelligence that’s simply impossible to get on your own. They have access to those juicy off-market opportunities that never hit the public listings, real-time data on what similar businesses are paying, and the inside scoop on which landlords are feeling generous with concessions. They also know which buildings have maintenance issues that the glossy brochures won’t mention.

I still remember helping a tech startup that was ready to sign a lease in what seemed like a perfect Brickell office. Through our network, we finded the building had experienced three major HVAC failures in the past year – information that wasn’t publicly available but would have created nightmare scenarios for their server room. That’s the kind of intel that saves businesses.

Your broker also brings relationship leverage to the negotiating table. Commercial real estate is still very much a relationship business. When your broker has history with landlords and their representatives, they understand what motivates them and where they might bend. They can also create competitive bidding situations that drive your costs down.

As one of our clients put it: “Before working with Signature Realty, I tried negotiating directly with a landlord and left significant money on the table. Their broker knew I had limited options and used it against me. Having professional representation on my next lease saved me over $40,000.”

Perhaps most valuably, your broker handles the entire transaction management process from search to move-in. They coordinate all the documentation, oversee due diligence, and can even help manage your space planning and build-out. This frees you to focus on what matters most – running your business.

Now, about broker compensation. Commercial real estate brokers typically earn a commission based on the total gross lease value (annual rent multiplied by the number of years). For example, on a three-year lease at $24,000 annual rent ($2,000 monthly), the gross lease value would be $72,000.

Here’s the part many tenants don’t realize – you’re effectively paying for broker services whether you use them or not. The landlord has already factored commission into their financial projections. By not having representation, you’re leaving valuable professional services on the table while still indirectly covering the cost. It’s like paying for a lawyer but letting the other side use them.

Property Management Matters

Trust me on this one – the quality of property management will make or break your tenancy experience. I’ve seen beautiful, premium spaces turn into tenant nightmares solely because of poor management.

Pay special attention to maintenance responsiveness. How quickly do they address issues? Are there clear communication protocols when problems arise? Do they offer transparent reporting for those CAM charges we discussed earlier? Many modern properties now offer technology platforms for service requests – a huge time-saver when you need something fixed.

“A client leased space in a beautiful Class A building in Coral Gables, but property management was outsourced and unresponsive,” recalls our property specialist. “Simple maintenance requests took weeks, creating significant disruption. In their next lease, we prioritized buildings with on-site management and a proven track record.”

When touring potential spaces, ask current tenants about their experience with management if you get the chance. Their candid feedback is worth its weight in gold. Also ask about the tenant improvement oversight capabilities – poor management during your build-out can lead to costly delays before you even move in.

For businesses managing their own properties or considering their options, learn more about our Professional Property Management Miami services.

Need specialized help finding your perfect commercial property for lease? Explore our Office Tenant Representation Services and Industrial Tenant Representation offerings. We’ve helped businesses like yours save millions through strategic representation, and we’d love to do the same for you.

And if you’re curious about alternative workspace solutions, check out this interesting case study on co-working spaces that might give you some fresh ideas for your business.

Market Trends & Flexible Space Options

The commercial property for lease landscape is constantly evolving. Understanding current trends helps businesses make forward-thinking leasing decisions.

The commercial real estate world looks dramatically different today than it did just a few years ago. In South Florida, we’re witnessing some fascinating shifts that savvy business owners can leverage to their advantage.

Remote work has permanently altered how companies use office space. Many of our clients are shrinking their footprints by 15-30% as they accept hybrid models. This doesn’t mean the office is dead – far from it! Instead, businesses are reimagining how their spaces function.

“I’ve had clients completely flip their space allocation,” shares our market analyst. “Where they once had 70% dedicated desks and 30% collaboration space, they’re now doing the exact opposite. It’s not about less space – it’s about different space.”

The increased availability in traditional offices has created a “flight to quality” phenomenon. Tenants can now upgrade to higher-class buildings while maintaining similar budgets. Why settle for that tired Class B space when you could move to a Class A building with better amenities for comparable costs?

In Miami-Dade, the sublease market has exploded with availability up 40% year-over-year. This creates fantastic opportunities for cost-conscious tenants. One of our technology clients recently secured a fully-furnished sublease space at a 35% discount from direct lease rates – complete with high-end furniture that would have cost them $200,000 to purchase new.

Regional rent variations tell an interesting story:

– Downtown Miami commands $45-65/sq ft for Class A office space

– Doral offers relative value at $35-45/sq ft for similar quality

– Hialeah industrial remains competitive at $12-18/sq ft NNN

– Miami Beach retail continues to demand premium rates of $60-120/sq ft NNN for prime locations

Meanwhile, industrial vacancy remains tight at just 3-5%, driven by e-commerce growth and supply chain restructuring. If you’re in the market for warehouse space, starting your search early is absolutely critical.

The co-working world has matured tremendously, with operators like Bridge Space offering sophisticated solutions that go far beyond the basic shared desk. Today’s flexible workspaces feature private office suites with corporate branding, enterprise solutions for larger teams, and hybrid membership models that support distributed workforces.

“We placed a marketing agency in a co-working environment as a six-month solution while their permanent space was being built out,” recalls our tenant rep specialist. “They loved it so much – especially the networking opportunities with potential clients – that they decided to stay permanently and reallocate their build-out budget to other business needs.”

Off-Market & AI-Driven Search Advantages

Did you know that traditional listing services only capture about 70% of available commercial spaces? The remaining 30% exist in what we call the “off-market” world – and these hidden gems often offer the best opportunities.

Off-market properties typically come with less competition from other tenants, giving you more negotiating leverage and potentially better economic terms. You might also get customization opportunities before the space hits public marketing channels.

“It’s like getting to shop before the store officially opens,” explains our lead broker. “You’re not fighting through crowds, and you might find exactly what you want before anyone else even knows it’s available.”

At Signature Realty, we’ve developed a proprietary AI deal analyzer that gives our clients a significant edge in finding these opportunities. Our system processes thousands of lease comparables to identify true market values – not just asking prices. It can predict which buildings may have upcoming vacancies based on tenant behavior patterns and analyze landlord concession tendencies to optimize your negotiation strategy.

This technology recently helped us identify an off-market opportunity for a financial services client that was 20% below market rate. The current tenant hadn’t even announced their departure plans, but our system flagged several indicators suggesting they were preparing to vacate.

The data-driven approach extends to lease analysis as well. When presented with different lease structures, our system can quantify the true financial impact of each option, accounting for variables like free rent periods, escalation clauses, and TI allowances. This transforms what would be gut-feel decisions into strategic choices backed by hard numbers.

For businesses interested in exploring these off-market opportunities and experiencing our AI-driven approach firsthand, visit our Lease Properties page to learn more.

Frequently Asked Questions about Commercial Leasing

What documents do landlords usually require?

Walking into a landlord meeting unprepared can leave you scrambling at the last minute. I’ve seen tenants lose prime spaces simply because they couldn’t produce paperwork quickly enough.

Most landlords will ask to see your business financial statements from the past 2-3 years – that means your profit and loss statements, balance sheets, and cash flow documents. If you’re a smaller business or startup, be ready to share personal financial information too. Landlords want reassurance that someone can cover the rent if business slows down.

“I always tell my clients to prepare their documentation package before we even start touring,” shares one of our leasing specialists. “Class A buildings in Brickell will scrutinize your financials much more carefully than an industrial landlord in Hialeah might.”

Your business plan becomes especially important if you don’t have years of financial history. Landlords want to understand your growth trajectory and how you plan to succeed. Most will also request bank references, credit reports, and proof of insurance before moving forward.

You’re essentially asking someone to trust you with a space worth hundreds of thousands or millions of dollars – they need to feel confident in your stability.

How long does it take to secure a lease?

The short answer? Plan for 2-6 months from initial search to move-in day. The long answer is (as always in real estate): it depends.

I recently helped a technology company secure a 5,000 square foot office space in just 6 weeks from first tour to keys-in-hand. Meanwhile, a medical practice’s build-out took nearly 8 months due to specialized requirements and permitting delays.

Your timeline typically breaks down like this:

– Finding and touring spaces: 2-4 weeks (longer if you’re being selective)

– Negotiating your Letter of Intent: 1-2 weeks

– Working through lease documents with attorneys: 2-6 weeks

– Completing due diligence and planning your space: 1-3 weeks

– Executing the lease and preparing to move: 1-4 weeks

“The biggest timeline variable is often how decisive the tenant can be,” notes our transaction manager. “In competitive areas like Miami Beach or Wynwood, hesitating for even a few days can mean losing a great space to another business.”

If you need to be in a space by a specific date, I recommend starting your search at least 6 months in advance. This gives you negotiating leverage and prevents rushed decisions.

What’s the difference between TI allowance and rent abatement?

These two landlord concessions often cause confusion, but they serve very different purposes in your lease.

Tenant Improvement (TI) allowances are specifically for building out or renovating your space. Think new walls, flooring, lighting, or specialized equipment installations. Landlords typically offer this as a dollar amount per square foot – ranging from $15-60 in South Florida depending on the property class and your lease length.

“I just helped a law firm negotiate a $45 per square foot TI allowance on their new Coral Gables office,” our leasing director shares. “That translated to over $200,000 in landlord-funded renovations, including custom conference rooms and a high-end reception area.”

Rent abatement (often called “free rent”) is exactly what it sounds like – months where you don’t pay rent. This might come at the beginning of your lease while you’re building out the space, or it might be spread throughout the term to improve your cash flow.

The beautiful thing about understanding these differences is that you can strategically prioritize what matters more to your business. Need extensive renovations? Push for a higher TI allowance. More concerned about initial cash flow? Negotiate additional months of free rent.

In today’s South Florida market, we typically see landlords offering 1-2 months of free rent per lease year and more generous concessions for tenants signing longer terms. With our proprietary AI deal analyzer, we’ve helped clients identify exactly where landlords have flexibility to increase these concessions beyond their initial offers.

Conclusion

Finding the perfect commercial property for lease is a journey that impacts your business for years to come. With typical lease commitments spanning 3-10 years, the decisions you make today will shape your company’s future in meaningful ways.

I’ve seen how understanding the nuances of different property types, lease structures, and market trends can make or break a business’s real estate experience. The difference between an informed tenant and an unprepared one often translates to thousands—sometimes millions—of dollars over a lease term.

At Signature Realty, we’ve spent the last 13+ years immersed in South Florida’s vibrant commercial real estate landscape. During this time, we’ve developed something truly special: a blend of deep market knowledge, technological innovation, and genuine care for our clients’ success. Our proprietary AI deal analyzer doesn’t just crunch numbers—it uncovers opportunities that others miss.

“The data-driven approach Signature used saved us nearly $300,000 over our five-year lease,” shared a recent client, a growing tech company that relocated to Brickell. “But what really impressed us was how they translated complex market data into clear, actionable insights that helped us make confident decisions.”

Off-market opportunities have become our specialty. While most businesses limit their search to publicly listed properties, our clients gain access to that hidden 30% of the market—spaces that never appear on listing services. These exclusive opportunities often come with less competition and more favorable terms, creating a significant advantage in tight markets.

Whether you’re searching for sleek office space in downtown Miami, an industrial facility with specific loading requirements in Doral, or high-visibility retail frontage in Miami Beach, having an experienced advocate makes all the difference. Our tenant representation approach has saved clients over $2 million in lease negotiations—real dollars that directly impact bottom lines.

Commercial real estate negotiations aren’t just about rental rates. They involve complex terms like escalation clauses, expense pass-throughs, and improvement allowances that can dramatically affect your total occupancy costs. Having someone who speaks this language fluently—and who represents only your interests—levels the playing field against landlords and their representatives.

Ready to explore your options with confidence? Our team is passionate about guiding businesses through every step of the commercial leasing journey. Find our exclusive off-market deals or reach out today to discuss your specific needs.

In commercial real estate, knowledge truly is power—and having the right partner can transform what feels like an overwhelming process into a strategic advantage for your business.